Ghana’s “Year of Return” in 2019 and its decade-long “Beyond the Return” initiative have transformed the country into a leading destination for diaspora investment. What began as a symbolic reconnection has evolved into a strategic framework designed to attract sustainable economic participation from people of African descent around the world. Central to this transformation is the real estate sector, which continues to receive strong policy support and legal reforms aimed at enhancing security of tenure and investor confidence.

Table of Contents

ToggleThe enactment of the Land Act 2020 (Act 1036) marks a significant milestone in simplifying property acquisition and addressing long-standing issues related to land ownership, documentation, and disputes. Supported by institutions such as the Ghana Investment Promotion Centre (GIPC) Diaspora Desk and the Office of Diaspora Affairs, this new environment emphasizes transparency, due diligence, and constitutional compliance. However, while processes have been streamlined, investors must still navigate key distinctions between citizenship, residency, and leasehold rights to secure their investments effectively.

While the national initiatives have fostered a welcoming environment and resulted in streamlined administrative support, the perception of “simplified property acquisition” must be understood as administrative and legal reinforcement, not an elimination of necessary due diligence [2, 4]. The most profound simplification mechanism is the enactment of the Land Act 2020 (Act 1036), which directly addresses historical tenure insecurity and systemic challenges, backed by dedicated governmental support infrastructure, notably the Ghana Investment Promotion Centre (GIPC) Diaspora Desk and the Office of Diaspora Affairs [5, 6, 7].

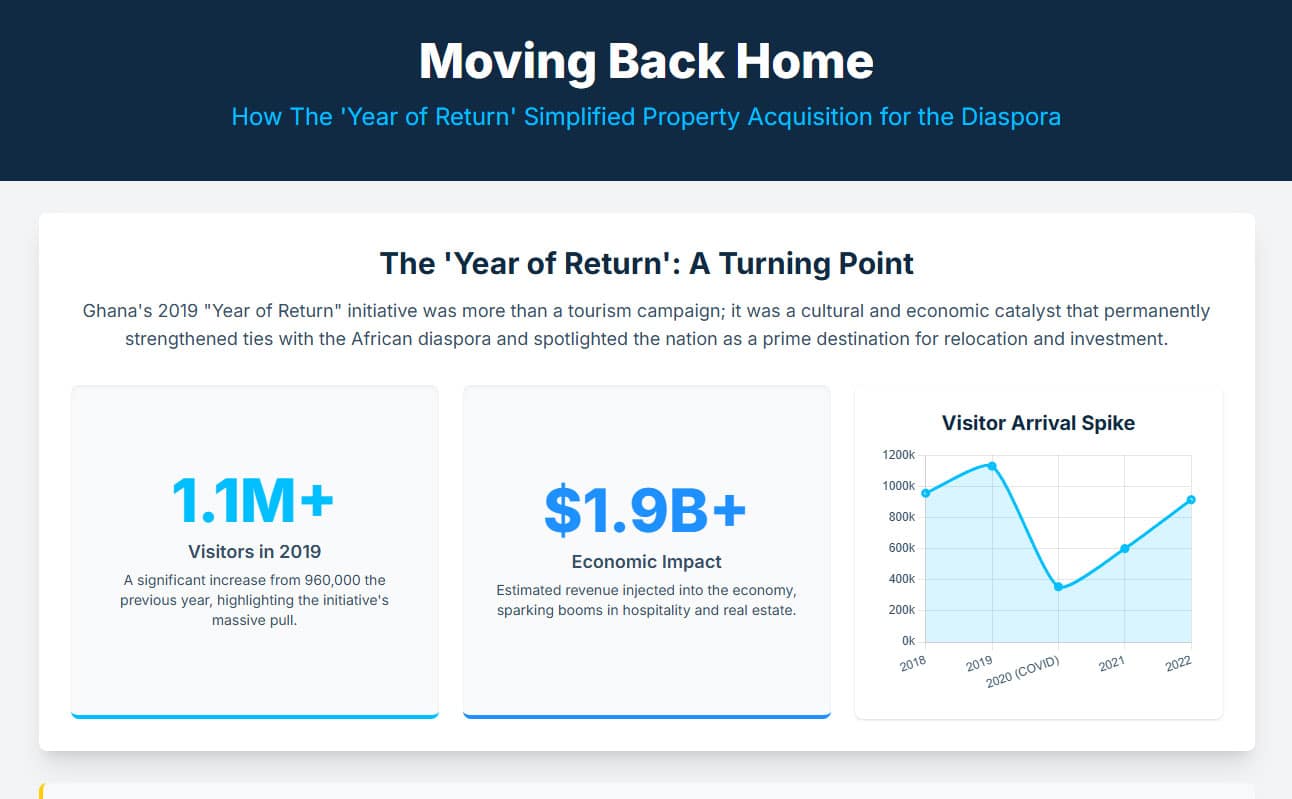

The Year of Return commemorated 400 years since the first recorded enslaved Africans arrived in Virginia, marking a profound historical and emotional reconnection for the global African family. Building on that success, the Beyond the Return program (2020–2030) shifted focus from symbolic celebration to tangible economic participation under the theme “A Decade of African Renaissance.” This phase emphasizes tourism, trade, and investment as drivers of sustainable development.

Real estate quickly became one of the most attractive sectors for diaspora investment, particularly in Accra, Cape Coast, and Kumasi. To manage this growing interest, the government established clear institutional frameworks to guide investors and minimize risks. The GIPC Diaspora Desk now plays a central role in promoting and facilitating diaspora-led projects, while the Diaspora Affairs Office provides verified information, investment support, and access to credible local partners.

These efforts are grounded in a strong economic incentive: remittances from Ghanaians abroad and the broader diaspora account for billions of dollars annually, representing over ten percent of Ghana’s GDP. The government’s commitment to land reform and investor protection reflects a strategic understanding that secure property rights are essential to sustaining this flow of capital and confidence.

For diaspora investors, understanding the link between legal status and land tenure is crucial. Ghana’s constitution differentiates clearly between citizens and non-citizens, and this distinction directly determines the duration and security of property ownership.

Ghanaian citizens are entitled to leasehold terms of up to 99 years, providing stronger inheritance potential and long-term asset value. Non-citizens, on the other hand, are limited to 50-year leaseholds, renewable upon expiration but with additional negotiation and cost implications. This difference can significantly affect the overall return on investment and long-term planning for property owners.

Foreign nationals can live and work in Ghana under several legal categories, each offering distinct rights and limitations.

Standard Residence Permit: Granted for specific purposes such as business, employment, or study. Holders remain classified as non-citizens and are therefore limited to 50-year leaseholds.

Right of Abode: Designed for individuals of African descent in the diaspora, this status allows indefinite residence and the right to work without visa or permit requirements. However, it does not grant full citizenship rights, meaning holders remain subject to the same 50-year land tenure limit.

Ghanaian Citizenship: Acquiring citizenship either by descent or registration is the only path that provides access to the full 99-year leasehold tenure and favorable tax rates. Applicants with Ghanaian parentage can claim citizenship by descent, while others may qualify through naturalization or registration after maintaining legal residence for a minimum period, typically five years.

Land in Ghana operates under a dual system that combines statutory and customary law. Freehold ownership is rare and mostly reserved for state-granted lands to citizens. For most investors, leasehold remains the standard arrangement, allowing exclusive use of land for a defined period while maintaining ownership of the physical structures built upon it.

The Land Act 2020 modernized this system by introducing reforms that directly enhance investor security. The law criminalizes illegal land guard operations, introduces electronic conveyancing to reduce document fraud, and establishes Customary Land Secretariats to ensure accurate record-keeping. Together, these measures create a more predictable and transparent process for both citizens and diaspora investors.

To minimize risk and ensure a legally defensible investment, every diaspora investor should follow these key steps:

These steps combine legal and practical protection, ensuring the property remains secure and properly documented.

Property acquisition in Ghana typically incurs transaction costs of between five and eight percent of the property’s total value. This includes transfer tax, stamp duty, and legal fees.

Annual property rates vary between 0.5 and 3 percent, depending on the property type and municipality. Rental income is also subject to withholding tax, which differs significantly by residency status. Non-residents pay 15 percent, while residents and citizens pay only 8 percent. This recurring seven percent gap provides a clear financial advantage to those who establish formal residency or citizenship.

The Ghanaian government also maintains a liberal policy on capital repatriation, allowing investors to transfer profits abroad through authorized banks. Combined with an annual appreciation rate of five to seven percent in property values, the market presents a stable and attractive option for long-term wealth preservation.

Ghana’s real estate landscape is evolving into one of Africa’s most structured and transparent environments for diaspora investment. Through progressive policies, institutional support, and comprehensive legal reforms, the country offers both emotional and economic value to those seeking to reconnect with their roots while building generational wealth.

The combination of policy vision, legal safeguards, and consistent market growth makes Ghana not just a sentimental homecoming destination but a practical, secure, and rewarding investment hub for the global African diaspora.